1. Avoid Weekend Gaps

Many market participants are knowledgeable of the fact that most popular markets close their doors on Friday afternoon Eastern Time in the US. Investors pack up their things for the weekend, and charts around the world freeze as if prices remain at that level until the next time they are able to be traded. However, that frozen position is a fallacy; it isn’t real. Prices are still moving to and fro based on the happenings of that particular weekend, and can move drastically from where they were on Friday until the time they are visible again after the weekend.

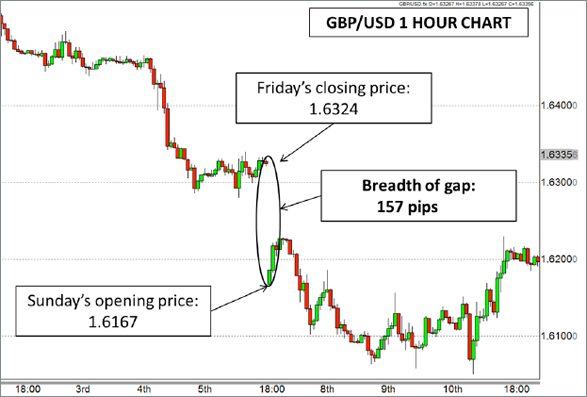

This can create “gaps” in the market that can actually run beyond your intended stop loss or profit target. For the latter, it would be a good thing, for the former – not so much. There is a possibility you could take a larger loss than you intended because a stop loss is executed at the best available price after the stop is triggered; which could be much worse than you planned.

While gaps aren’t necessarily common, they do occur, and can catch you off guard. As in the illustration below, the gaps can be extremely large and could jump right over a stop if it was placed somewhere within that gap. To avoid them, simply exit your trade before the weekend hits, and perhaps even look to exploit them by using a gap-trading technique.

2.Customize Your Contracts

The amounts of methodologies to use in trading are virtually endless. Some methods have you use a very specific stop loss and profit target on each trade you place while others vary greatly on the subject. For instance, if you use a strategy that calls for a 20-pip stop loss on each trade and you only trade the EUR/USD, it would be easy to figure out how many contracts you may want to enter to achieve your desired result. However, for those strategies that vary on the size of stops or even the instrument traded, figuring out the amount of contracts to enter can get a little tricky.

One of the easiest ways to make sure you are getting as close to the amount of money that you want to risk on each trade is to customize your position sizes. A standard lot in a currency trade is 100,000 units of currency, which represents $10/pip on the EUR/USD if you have the U.S. dollar (USD) as your base currency; a mini lot is 10,000.